If you die in service before normal retirement age, your Fund Value will be distributed to your dependants and nominees by the Trustees, according to Section 37C of the Pension Funds Act.

Any portion of the approved death benefit that is paid out in cash will be taxed as follows:

Lump sum Amount | Rate of Taxation |

0 - R500 000 | 0% of taxable income |

R500 001 - R700 000 | 18% of taxable income above R500 000 |

R700 001 - R1 050 000 | R36 000 plus 27% of taxable income above R700 000 |

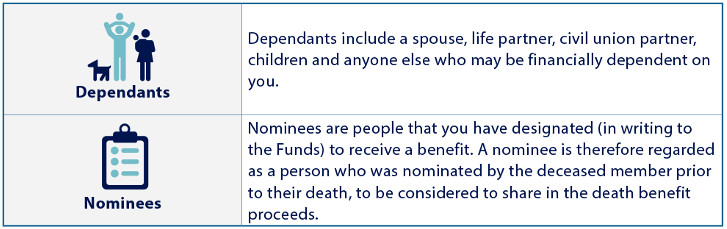

The people who are eligible to receive your benefit can be divided into two groups:

Section 37C of the Pension Funds Act and the rules of the Funds state that, in the event of your death, your benefit should be distributed as follows:

Your Nomination of Beneficiary Form is used to guide the Trustees when allocating your benefits. They have a duty to distribute your death benefit to dependants and/or nominees in a manner that they believe to be equitable to all parties.

You should review your beneficiaries at least annually. You can download your form here.

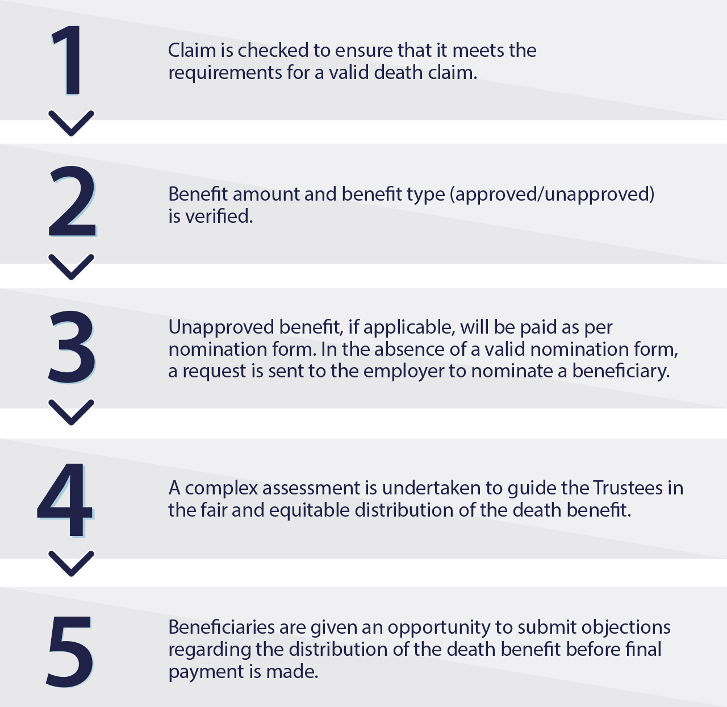

How to claim for a death benefit

Please ensure that the following documents are submitted to the deceased member’s employer:

- Death Notification, fully completed and signed by the Authorised Signatory at the employer

- Certified copy of Death Certificate

- Proof of age (ID) for the late member and all potential beneficiaries

- Tax details (employer PAYE reference number, member tax number, and salary history)

- Marriage Certificate if there is a spouse