When you reach normal retirement age, you become entitled to a benefit equal to your Fund Value. This is a sum that represents the total contributions made, together with the investment returns achieved, less expenses.

Each participating employer decides on a normal retirement age for its staff.

Should your employer agree, you may retire at a later date; OR earlier, after attaining age 55; OR at any time if your retirement is due to ill health and you are not eligible to receive a benefit from the Disability Income Plan.

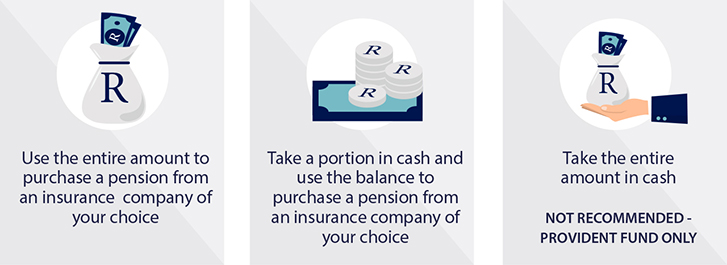

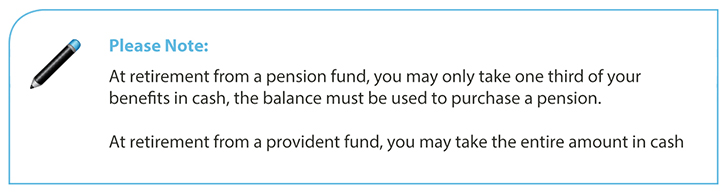

When retiring, you have the following options:

Any portion of your benefit that you choose to take in cash will be taxed as follows:

Lump sum amount | Rate of Taxation |

| 0 - R500 000 | 0% of taxable income |

| R500 001 - R700 000 | 18% of taxable income above R500 000 |

| R700 001 - R1 050 000 | R36 000 plus 27% of taxable income above R700 000 |

Any benefit previously received tax free will be deducted from the tax-free amount.